- Learning

- Canadian Securities Course (CSC®)

- Investment Funds in Canada (IFC)

- Conduct and Practices Handbook Course (CPH®)

- Wealth Management Essentials (WME®)

- Derivatives Fundamentals and Options Licensing Course (DFOL)

- Investment Management Techniques (IMT®)

- Advanced Investment Strategies (AIS)

- Portfolio Management Techniques (PMT®)

- Partners, Directors and Senior Officers Course (PDO)

- Branch Compliance Officer's Course (BCO)

- Investment Dealer Supervisors Course (IDSC)

- WME Course For Financial Planners (WME-FP)

- Chief Compliance Officers Qualifying Examination (CCO)

- Derivatives Fundamentals Course (DFC)

- Trader Training Course (TTC)

- Options Supervisors Course (OPSC)

- Futures Licensing Course (FLC)

- WME Course For Investment Managers (WME-IM)

- Options Licensing Course (OLC)

- New Entrants Course (NEC)

- WME Course For Wealth Managers (WME-WM)

- Chief Financial Officers Qualifying Examination (CFO)

- Canadian Commodity Supervisors Exam (CCSE)

- View All Licensing Courses

- Certificate in Financial Services Advice (CFSA)

- Certificate in Advanced Financial Advice (CAFA)

- Certificate in Advanced Investment Advice (CAIA)

- Certificate in Small Business Banking (CSBB)

- Certificate in Technical Analysis (CITA)

- Certificate in Investment Dealer Compliance (CIDC)

- Certificate in Derivatives Market Strategies (CDMS)

- Certificate in Retirement Strategy (CRS)

- Certificate in Estate Planning & Trust Strategy (CETS)

- Certificate in Commercial Credit (CICC)

- Certificate in Personal Banking (CPB)

- Certificate In Bank Management (CBM)

- Micro-Certificate in Alternative Investments (MCAI)

- View All Certificate Pathways

- Fellow of CSI (FCSI®)

- Personal Financial Planner (PFP®)

- Chartered Investment Manager (CIM®)

- Certified International Wealth Manager (CIWM)

- Designated Financial Services Advisor (DFSA™)

- Estate & Trust Professional (MTI®)

- CSI Path to Certified Financial Planner (CFP®)

- CSI Path to Qualified Associate Financial Planner (QAFP™)

- CSI Path to Financial Planning Program – Quebec (IQPF)

- View All Designation Pathways

- Personal Financial Services Advice (PFSA)

- Financial Planning I (FP I)

- Financial Planning II (FP II)

- Financial Planning Supplement (FPSU)

- Investment Advisors Training Program (IATP)

- Financial Planning Integration Course (FPIC)

- Applied Financial Planning Certification Exam (AFP)

- CIWM Certification Examination

- Life Licence Qualification Program Insurance Course (LLQP)

- View All Courses

Featured Product

Conquer the Financial Services Landscape with the CSC®

Receive a 10% discount on the CSC until April 30.

Featured Product

CFSA: Preferred Credential for Personal Bankers

Better understand your clients' unique financial needs and goals to build positive client relationships with the CFSA.

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

Featured Product

Explore Multiple Career Paths

Explore different roles and opportunities available in the financial services industry and view the recommended courses and credentials.

Featured Product

Meet CE Requirements Quickly and Easily

Explore continuing education courses and meet your requirements for CSI, CIRO, CSF and other professional associations or certifications.

Featured Product

Drive Effective Client Conversations

Get started with the Personal Financial Services Advice (PFSA) course to enhance your soft skills and build profitable client relationships.

Featured Product

Explore Multiple Career Paths

Explore different roles and opportunities available in the financial services industry and view the recommended courses and credentials.

- Exams & Administration

Featured Product

Canadian Securities Course CSC®

Featured Product

Preparing to Take Your CSI Exam?

Write your exam through Remote Proctoring from any location (including your home) or In-Person at one of our test centres.

- Credentials

Featured Product

Credentials That Matter

Meet the highest standards of experience & education for financial professionals with CSI certificates, designations & fellowship.

Featured Product

FCSI® – The Highest Honour in Financial Services

Join an elite group of leaders in financial services and make a meaningful impact for your clients with the Fellow of CSI (FCSI®).

Featured Product

PFP® – The Premier Credential for Financial Planners

Master financial planning skills with the ISO and FSRA-certified Personal Financial Planner (PFP®) designation.

Featured Product

CIM® – The Recognized Credential for Investment Managers

Learn how to manage money on a discretionary basis for sophisticated clients with Chartered Investment Manager (CIM®).

Featured Product

CIWM – The Leading Credential for Wealth Managers

Establish your credibility to address the unique needs of affluent clients with Certified International Wealth Manager (CIWM).

Featured Product

DFSA - The leading credential for financial advice in Canada

Featured Product

MTI® – Prestigious Credential for Trust & Wealth Managers

Gain expertise in the regulations and tax implications that are crucial for management and transfer of wealth with MTI®.

- Corporate Solutions

Featured Product

Find Qualified Candidates Faster

Talent Pro connects organizations with qualified and licensed candidates to fill active opportunities in the banking industry.

Featured Product

Find Qualified Candidates Faster

Talent Pro connects organizations with qualified and licensed candidates to fill active opportunities in the banking industry.

- Insights

Featured Product

Decoding Sustainable Investing: Strategies for the Canadian Market

Gain valuable insights to navigate the rapidly evolving ESG and Sustainable Investing realm.

Featured Product

Webinars to Boost Financial Literacy

During Financial Literacy Month we aim to help Canadians understand their finances better & navigate the changing economic landscape.

Featured Product

Become a Speaker With CSI

CSI Podium offers designation holders opportunities to speak on topics to benefit their clients, colleagues, and the investing public via webinars.

- About

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

Featured Product

PFP® Approved Under FSRA Title Regulation

FSRA has approved the Personal Financial Planner (PFP®) designation for Financial Planner title use in Ontario.

CSI will be performing system maintenance on Saturday May 11th from 5 a.m. until 1 p.m. ET. You will not have access to your “myCSI” student account, nor will you be able to book, cancel or reschedule exams during this time. You can still access your online course materials by visiting connect.csi.ca then connecting to “Blackboard Learn”.

Certificate in Fixed Income Trading and Sales (CFIT)

Home > Learning > Certificate Pathways > Certificate in Fixed Income Trading and Sales (CFIT)

What is the Certificate in Fixed Income Trading and Sales?

The Certificate in Fixed Income Trading and Sales will provide a firm understanding of the structure, operations and strategies of fixed income trading from both the buy and sell side. You will learn how to identify a variety of business, financial and compliance risks that occur when selling and maintaining an inventory of fixed income securities. Completing this program will help you evaluate, trade, and sell various types of fixed income securities including bonds and mortgage-backed securities.

What skills will you develop?

- Effectively describe the responsibilities of a fixed income trader and sales person

- Detail the interaction and competitor/co-operator nature of the trading process

- Identify the key attributes a buy-side firm looks for in a fixed income dealer

- Describe what is represented by different yield curve shapes

- Calculate bond price changes given changes in duration and convexity

- Demonstrate active FI portfolio management strategies

- Explain the workings of a Mortgaged-Backed Security (MBS)

- Demonstrate how fixed income market risk is measured and mitigated

- Utilize fixed income derivatives to trade and manage risk

- Analyze fixed income market trends using technical analysis

- Gain soft skills to advance your customer relationships and sales skills

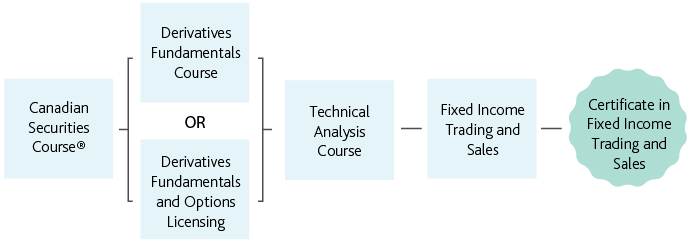

What is the path to the Certificate in Fixed Income Trading and Sales?

Who should enrol?

The Certificate in Fixed Income Trading and Sales is designed for students who have a post secondary diploma and have taken the Canadian Securities Course (CSC®). They are either in a junior trading desk role or are aspiring to move into a fixed income trading role. This includes people who are currently retail bond desk staff, money market traders, back office staff who aspire to work on a trading desk, investment representatives. Junior portfolio managers and junior analysts may also be interested.

Course work enables students to be in step with the professionalization trend in the financial services industry. A formal recognition of their knowledge and expertise in fixed income trading and sales helps them gain entry into this field or prepare them for career advancement from junior to more senior fixed income trading or sales positions.