CSI will be performing system maintenance on Saturday May 11th from 5 a.m. until 1 p.m. ET. You will not have access to your “myCSI” student account, nor will you be able to book, cancel or reschedule exams during this time. You can still access your online course materials by visiting connect.csi.ca then connecting to “Blackboard Learn”.

Digital, Holistic and Responsive: Refitting Advice Value Proposition for the Change of Guard in Canada’s Wealth

Financial advice market in Canada is poised for a sea change driven by multigenerational demographic shifts and proliferation of technology-enabled platforms.

To keep up with the sweeping changes in the demographic profile of Canada’s household wealth, advice-givers will need to reinvent both their value propositions, as well as their product and services shelves. For the industry, this translates into rewriting the playbook on client engagement—as existing clients’ needs change with the transition from the accumulation into the payout phase while the needs of new, younger, clients are different.

Compounding the impact of the arrival of younger cohorts of investors is the evolution of the industry competitive landscape. The entrance of technology-forward firms with new ideas about marketing, client engagement, pricing, and product shelf—all anchored in a constantly refined digital-first client experience (CX)—is intensifying competitive pressures for incumbent advisors. While their bark may still be bigger than their competitive bite, these firms are helping mint a new cadre of digitally native investors and, in the process, shaping their future expectations of experience with their financial services providers.

Opportunity Looms

While success is not a given, the opportunity for advice-givers looms large.

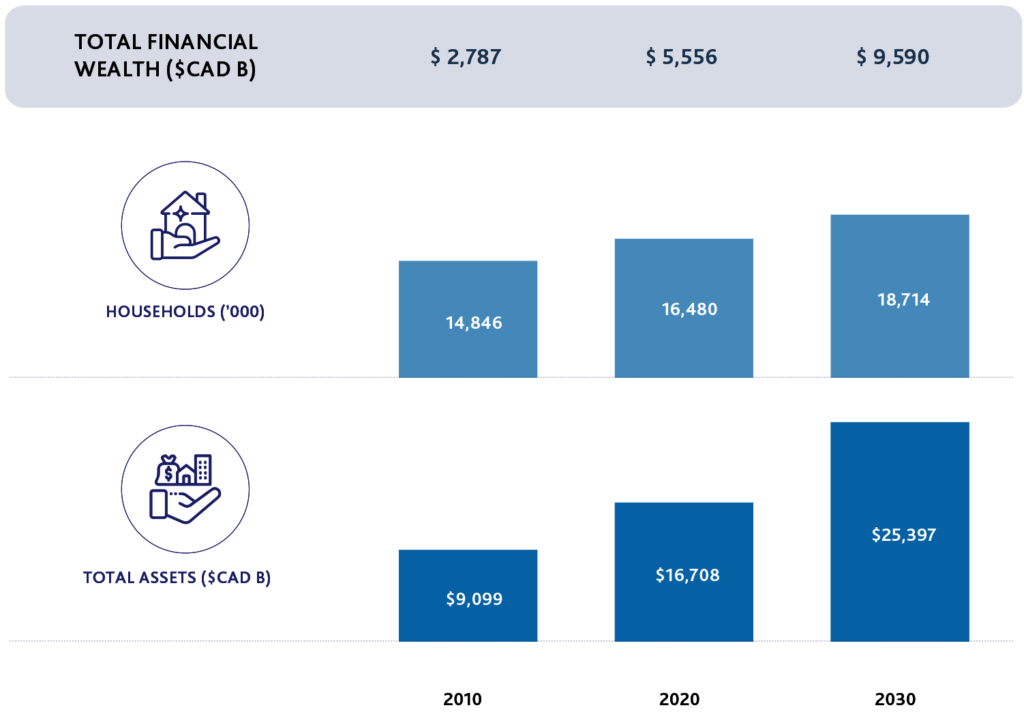

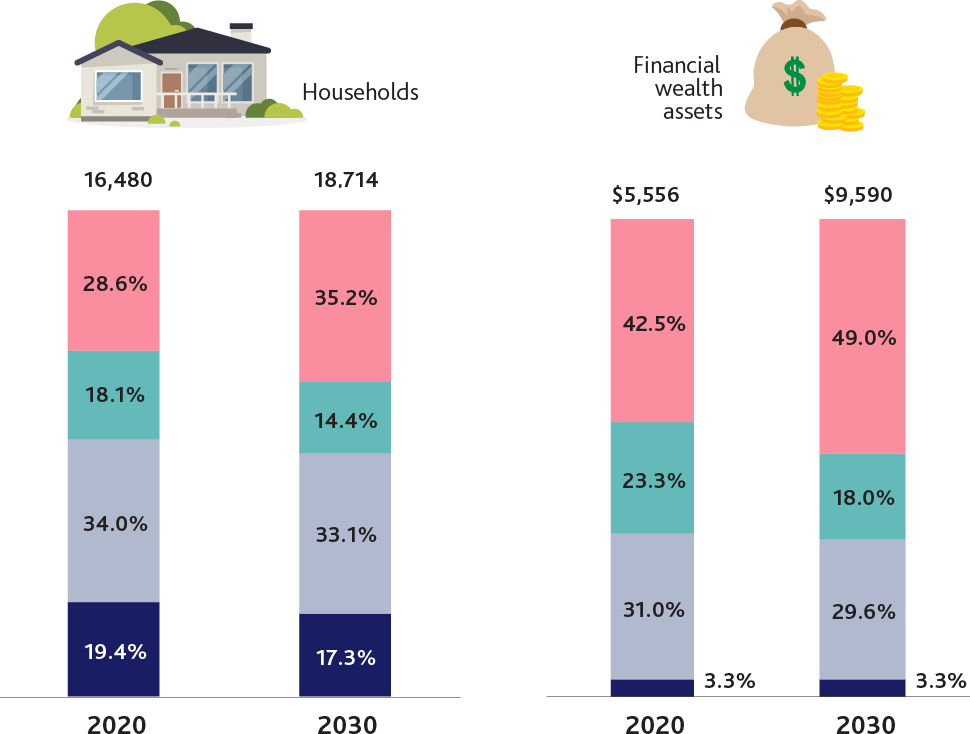

Throughout the 2020s Canadian households’ financial wallet will close to double in size from the $5.6 trillion in the end of 2020 to nearly $10 trillion by the end of the decade. (Figure 1). (ISS Market Intelligence’s/Investor Economics’ widely-used financial wealth metric includes all investable assets, from chequing and savings accounts, through mutual and other investment fund holdings, to direct security holdings in commission-based and non-discretionary and discretionary fee-based accounts, as well as holdings in group retirement savings plans, such as defined contribution plans and GRRSPs, but not those in defined benefit plans or government pension schemes whose deployment resides outside of the discretion of the investing household.)

1

Canadian Household Financial Wealth Is a Growth Opportunity But Slower Pace Will Intensify Competitive Strife

This robust expansion in the absolute dollar household financial wealth opportunity masks a significant slowdown in the relative pace of its growth. At 5.6% on an average annual compound basis, this more modest relative growth expectation, which includes market growth and new savings, will hardly be sufficient to satisfy everyone’s appetite for growth. Many advice-givers who started their businesses in the industry’s expansionary phase in the 1990s will have to either moderate their growth expectations or identify stronger growth pockets within the broader demand. In all cases, various players’ aspirations for growth will demand winning the “takeaway game”, by both winning clients from other providers and doing their best to stave off others’ competitive overtures towards their clientele.

Risk Off and Risk On… and Risk Off!

To add complexity to winning the battle for Canada’s household wealth, advice-givers are facing an increasingly bifurcated wealth picture. Globally, the pandemic created—or perhaps revealed—a tale of two economies: Those who were able to save, and those who struggled to make ends meet. The net result has been a significant cache of extra savings, given reduced consumer expenditure, by households in the former category.

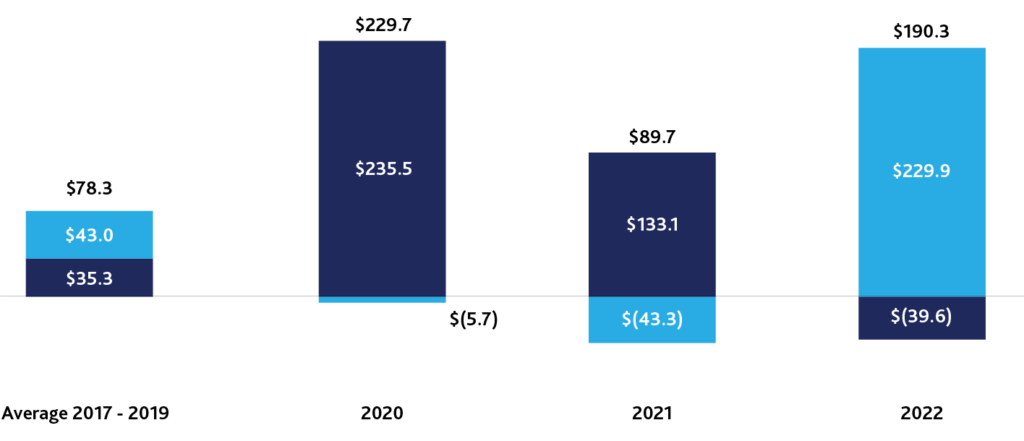

The Canadian households were no different. A closer look at the deposit activity during the pandemic years reveals robust inflows of roughly $320 billion (see Figure 2), largely into short-term/liquid deposits with the post-pandemic flows shifting into still risk-off deposit vehicles, such as the guaranteed interest certificates (GICs).

2

The Fear Factor: Canadian Households Continue to Sit on a Generous “Safety Cushion” Despite Some Rebalancing of Liquid Positions into Fund Flows in 2021. Time Will Tell How Impact Long-term Investor Outcomes

Assets or change in balances in billions of dollars

On the surface, this inflated liquidity cushion on the household balance sheet bodes well for the growth perspectives of advice-givers, many of whom are assisting those households with liquid position which can be mobilized into investments. Indeed, the growth of advice channels between 2020-2021 and the record-breaking investment fund flows in 2021 provide evidence of early success that advisors have had in mobilizing a portion of these pandemic-fueled savings.

3

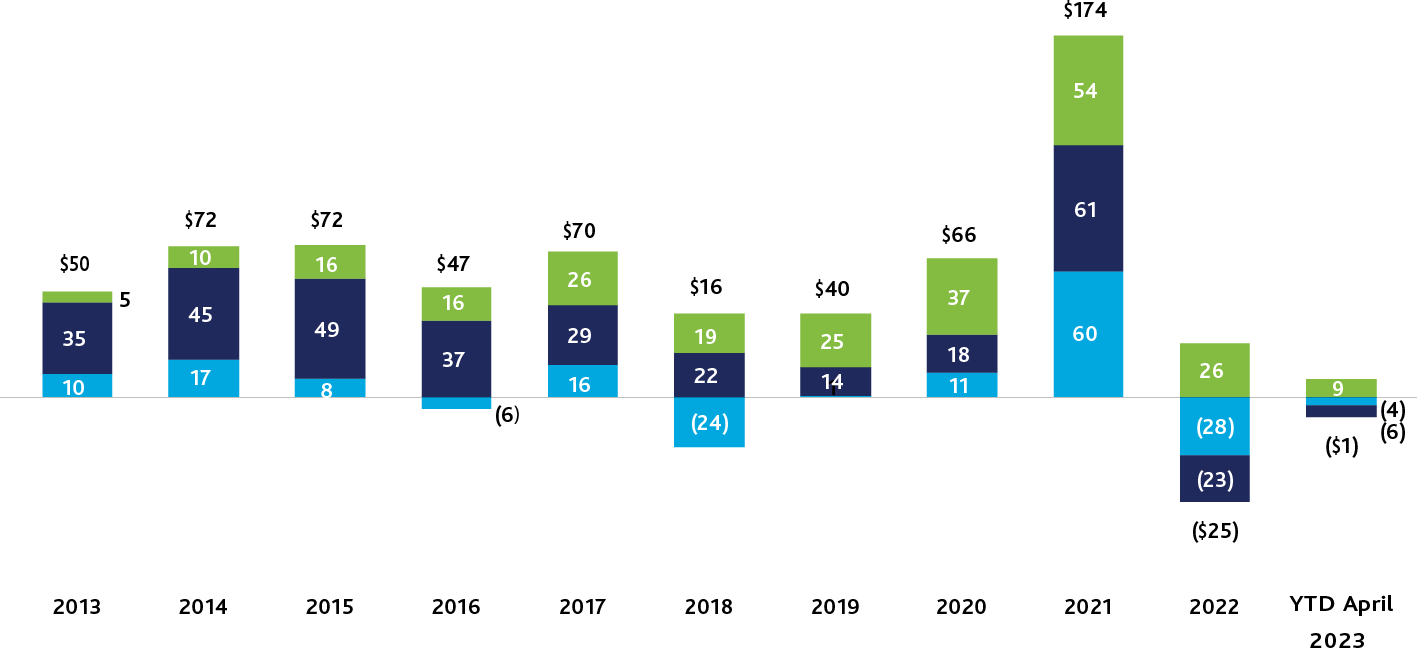

Asset Managers have Begun to Mobilize Savings Into Investments. In 2021, Investment Fund Inflows More than Doubled the Previous Annual Record. Concentration is High.

Long-term investment funds net flows in billions of dollars

As an aside, the pandemic appears to have released new pockets of growth opportunities for advice-givers. As the health threat articulated, topics such as estate planning, will preparation, life insurance, retirement preparedness, and investment selection and allocation, rose to prominence, further supporting the currently dominant position of advice-givers in guiding Canada’s households’ financial activities. At the end of 2022, forty-five per cent of Canada’s household financial wealth was held in advice channels (full-service brokerage, branch advice, financial advice, and private wealth management). According to a 2021 study by Ontario Securities Commission study “Self-Directed Investors—Insights and Experiences”, one in six investors in the direct investing channels sought the advice of a financial advisor.

Yet, in their attempt to mobilize these safety zone positions, advisors now face a challenge of arguing for “risk on” against a trio of “risk off” arguments—the aging of their client population, and the associated potential decline in appetite for risk-taking; the downtrending capital markets; and macroeconomic woes. As the exhibit illuminates, 2021 highs were followed by what could be most kindly described as a tough sales environment for investments in 2022 and in the year-to-date 2023. Absent strong payout phase and risk mitigation narratives, advisors might find themselves fighting a hard battle for new investment inflows.

Picking Your Spots

The current “sales strike” for investment vehicles raises the ante on client retention and on thoughtful selection of new client targets. (An important caveat here is that this general comment does not invalidate the success that certain investment strategies and vehicles have had in gathering assets in the past year and a half.) Deploying a winning advice value proposition in 2020s will demand both growing with the existing clients and developing relevant offers for those new client targets with the strongest growth potential in the coming years.

In short, advisors will be well advised to lean into demographic trends, whose progress has only been accelerated by the pandemic. In our view, the following three demographic themes represent significant growth opportunities but also potential retention challenges for advisors in the 2020s:

These three demographic cohorts have different financial priorities and financial advisors need to demonstrate agility in responding to the changing attitudes and priorities of their clients.

As per Investor Economics forecasts, by the year 2030, wealth held by those 55 years and older will have surpassed C$6.4 trillion, which is nearly double that of the $3.6 trillion held by this cohort in 2020 (see Figure 3).

This age segment will represent 67.0% of total financial wealth assets in the country at the end of the decade.

As per the World Economic Forum report (2019) titled “Investing in Our Future”, the retirement-to-savings gap in absolute terms for Canada by 2030 will be $8.1 trillion from $4 trillion in 2015.

4

Aging baby-boomers: Are advisors ready for the retirement phase advice-giving?

Households in thousands, assets in billions of dollars by age segment

Canada’s aging population has created a greater need for better and more flexible retirement products and services. The number of baby boomers who have entered retirement will only continue to rise over the next two decades. Their collective demand for accumulation-geared products will also continue to be replaced with demand for products offering principal repayment and interest income.

An associated opportunity for advisors is to tap the next generation of babyboomer families as the next wave of clients. To do so, financial advisors must reposition the focus of their advice and planning activity from the primary relationship holder to a more inclusive family one.

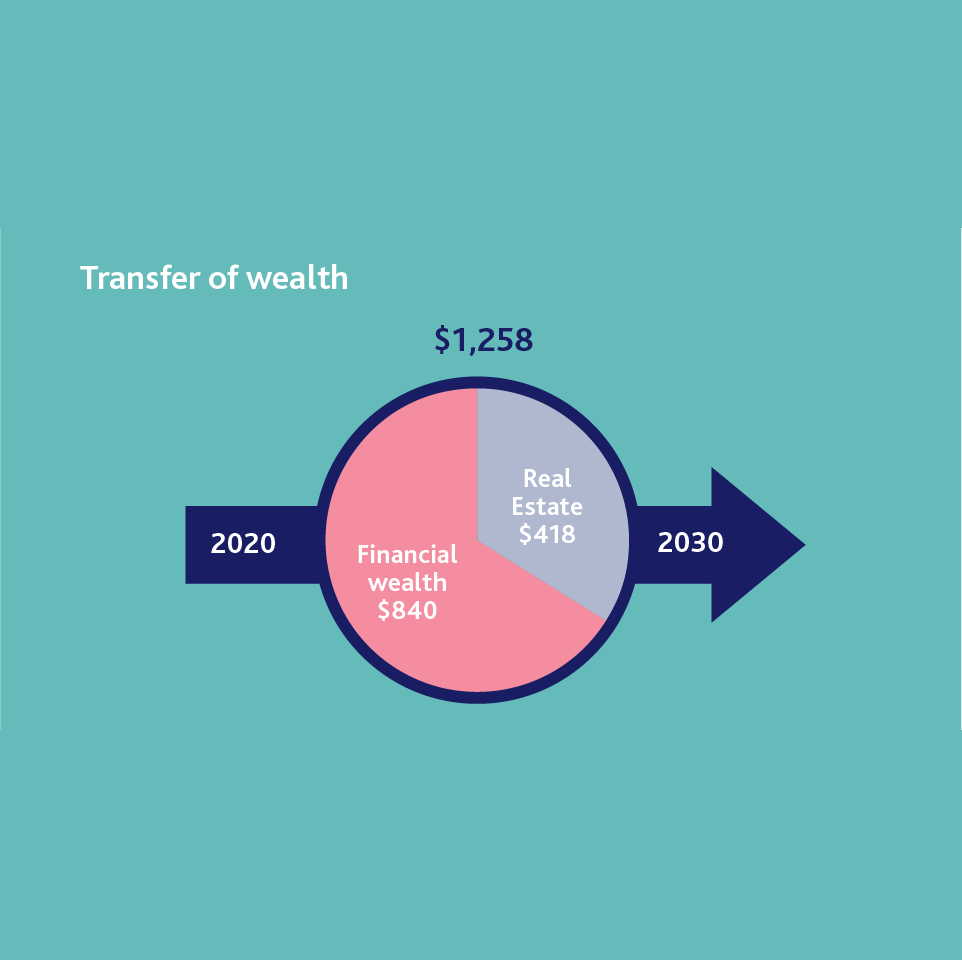

The intergenerational transfer of wealth through 2030 is larger than ever before:

Over $1.2 trillion from aging generations is set to be transferred to younger cohorts.

While many of the inheritances are going from one older generation to another, the millennial generation entering their wealth accumulation phase are set to change the way mass affluent and high net worth (HNW) clients look at the future.

If you’re an advisor and focusing solely on one individual’s retirement plan only without considering the wealth plan for a family, you run the risk of not retaining that business in the long-term.

In this fashion, babyboomer cohort represents an important target market for advisors servicing their retirement income needs while building trusted relationship with the next generation of clients.

We would be covering retirement payouts including inter-generational wealth transfer and implications on advice giving in our subsequent topic.

5

Changing Faces of Canada’s Affluent

HNW households dominate Canada’s financial wallet, but their needs are also changing

In 2030, around 78% of the total Canadian wealth will belong to the affluent household segment. An estimated 600 thousand households will have been “promoted” to this segment.

The millennials in this segment will account for ~ 20% of all financial wealth and 16% of households by 2030.

Note: The affluent segment, also known as the high net worth (HNW) segment, is defined by Investor Economics as comprising Canadian households with C$1 million or more in personal financial wealth that does not include any equity in real estate or private companies. The upscale segment (households with investible financial wealth between $500,000 and $1 million), which acts as the feeder segment to that of the affluent.

The concentration of Canada’s wealth ownership at the high end of the investor spectrum will continue unabated, and indeed advance, in the next decade. By the end of 2030, nearly $8 out of every $10 in investable wealth will be held by households with more than $1 million in investable assets. Adding to the complexity and to the potential opportunity is the existence of wealth sources outside our financial wealth metric: home equity and equity in privately held businesses. The size of the HNW opportunity and its strategic importance have been well-recognized by a wide range of players and is reflected in a plentiful field of competitors vying for position in the HNW segment.

Yet, even here, evidence is mounting that the client acquisition and retention strategies of the past might not prove winning formulas for the future. One reason is that the HNW segment is changing alongside broader trends observed in the Canadian society. From the growth and new opportunity perspectives, the dominance of traditional family wealth led by aging clients—which remains critical in terms of the absolute dollars held by HNW households—is being replaced by a more diversified cadre of HNW clients. Many HNW clients will “graduate” from lower wealth cohorts, suggesting a different expectation and a likely greater reliance on their incumbent advisors than many traditional HNW families whose generations of wealth-amassing have led them to develop expansive networks of legal, tax, financial, insurance, banking, business, and other financial experts. Additionally, new, and heretofore not dominant, HNW demand pockets will develop, including women-led households, wealthy first- and second-generation immigrant households, entrepreneurs, executives, and younger households. On the latter one out of every $5 in the HNW segment will be held by millennials in 2030.

This increasingly multi-hued HNW segment suggests the need to adapt the advice offer to the diverse needs and preferences of the various sub-cohorts residing therein. Going forward, advisors will likely see greater success in developing micro-targeting strategies rather than hope for the best with a one-size-fits-all- HNW-clients strategy. Understanding the nuances of the local addressable HNW market will be increasingly important for advisors with aspirations of growing their HNW footprint—and retaining their long-time clients graduating into the affluent ranks.

Female-led wealth on the rise

To win in the next decade, advisors must up their game to ensure relevance to female investors:

- In Canada women make up 50.3% of the population and 48% of the

workforce

- In 2000, 19% of tax filers were women who received more than $100,000

annual income, by 2018 the number of high-income women grew at 12.3%

CAGR.

- In 2018, around 31% women belonged to high-net-worth category

compared to 69% for their male peers.

- By 2030, it is expected that the share of Canadian financial wealth controlled by women will increase from 39% (in 2020) to 47% by 2030.

The importance of communication with women who need financial advice

Although there are many areas in need of improvement, one positive trend is the importance that female investors attach to planning and receiving professional advice. Despite increasing levels of female financial literacy, women are more likely to seek out an advisor and only 50% trust their own investment capability, compared to 65% of men.

Some of the complaints made by women (usually about male advisors) include the excessive use of jargon; a sense of being patronized; an assumption by advisors that wealth controlled by women comes from the husband or male partner; and an unwillingness to spend time understanding their life goals, as well as their financial goals.

But that is not the whole story. In addition, and unlike men, who tend to view prosperity as the goal, affluent women see the accumulation of wealth to accomplish a set of personal objectives, be it financial security for their family (a matter of importance to three quarters of affluent women); the establishment of a business; or an ability to support charities active in the local community, an objective of 72% of female entrepreneurs.

Expanding competitive field

Demands for advisors to adapt to the tectonic shifts in the demographic complexion of the household wealth are but one source of the new adaptation imperative. The second change stems from the expansion of the field of competitors vying for existing and future financial clients

Distribution of financial products has come a long way from when investors had to call up brokers or visit physical branches to transact in even traditional instruments like equities and bonds. The pandemic accelerated changes in consumer habits, like the forced switch to digital mode. This triggered preference for digital communication and execution which will likely persist and contribute to the gradual erosion of the importance of physical footprints.

360⁰ Competitive perspective

In Canada, the past 30 years may well be described as the Golden Age of Canadian retail wealth distribution. The nineties welcomed the rise of advice-givers as the engine of growth of the asset and wealth management industries. The new Millennium delivered a significant rise in the use of technology-driven channels such as online discount brokers and hybrid robo-advisory channels. Growing use of technology by distributors firms in the Teens decade of the 21st century allowed for greater scalability of their offers and allowed for the expansion of addressable client targets. The shift in targeting from one to multiple targets carries important implications for distributors in all wealth channels.

The battle now extends to wide array of competitors across diverse channels, so let’s take a 360-degree competitive view.

The Canadian distribution universe remains massive with 673 number of firms competing in nine distribution channels and housing 135,685 strong army of client-facing representatives.

In turn, this multiplication of potential competitors brings about two effects:

- More competitors = More competition

- By competing for the same target clients, distributors will expose their shelves of products and services to side-by-side comparisons. No longer will it suffice to calibrate one’s value proposition against like competitors, rather value narratives will have to withstand scrutiny against those of firms in all channels, with particular attention paid to product shelf and pricing strategies.

Digitize to delight

The intensification of competitive pressures and the growing consumer preference for digital engagement suggest the need for advice-givers and their dealers to expand their digital toolkit and help advisors to maximize client value proposition and revenue.

Wealth distributors can take a cue from what leading luxury goods brands did to broaden brand appeal and reach over the last decade to cater to the digital-native customers. Luis Vuitton, a luxury fashion brand, caught on with the increasing importance of e-commerce early as it went on an e-commerce launching spree. Currently, the luxury retailer has e-commerce platforms for their various outlets around the world including the UAE, Sweden, Singapore, and New Zealand.

Another example is the music industry, where companies like Spotify or Netflix have used data-driven insights from client experiences on their platforms to personalize content and create customized journeys for the individual customers. Spotify’s leadership understood the criticality of engaging with clients by delivery personalized content. The company evolved its processes by moving from curation to recommendation services, curating technology stack to best reach their customers and acquiring companies to enable personalized goals (i.e., TuneGo and EchoNest).

Another example is the music industry, where companies like Spotify or Netflix have used data-driven insights from client experiences on their platforms to personalize content and create customized journeys for the individual customers. Spotify’s leadership understood the criticality of engaging with clients by delivery personalized content. The company evolved its processes by moving from curation to recommendation services, curating technology stack to best reach their customers and acquiring companies to enable personalized goals (i.e., TuneGo and EchoNest).

In the same fashion, digital solutions can play a significant role in the wealth management industry, allowing advice-givers to operate and deliver services at a higher level of efficiency while also enabling a degree of customization.

Importantly, the greater utilization of technology is not aimed at displacing the need for personal interaction which has always been the service anchor and the critical element of relationship-building in the wealth management industry. Rather, the idea is to deploy digital solutions that can act as enablers while it is the wealth managers and financial advisors who will continue to develop and anchor relationships. As technology evolves further, the future of advice will be increasingly defined by data-driven automated insights, customized personal experiences, holistic advice across breadth of products, high levels of trust and transparency and value proposition to clients.

Building a resilient advice value proposition

Rapidly evolving demand curve and proliferating competition suggest advice-givers face a decade of change. Intriguing opportunities will be matched by a host of challenges, all pointing to the importance of crafting and delivering a well-thought-out value proposition, along with rich digital elements, all aimed at delighting the wealth management clients of today and attracting those of tomorrow.

In this quest, setting one’s value narrative apart from other financial advisors has always been an important aspect of business, regardless of where you are in your professional journey. As the industry becomes more saturated with advisors who have transitioned from a transaction focus to fee-based advice models— accurately conveying your unique value is no longer just important, it’s vital.

Education is one way for advisors in this space to distinguish themselves. In case you haven’t noticed, there are often more letters following an advisor’s name than in the name itself. Not to undermine the point, but there are over 100+ sets of professional credentials a financial planner can pursue and add to their title.

As per Investments & Wealth Research report findings, designations appear to play

an important role in advisors demonstrating knowledge and expertise:

- Nearly 8 of 10 clients agreed that the designations held by my advisor are an important way to demonstrate technical expertise.

- 7 of 10 felt that the designations held by my advisor set him/her apart from others. 83% indicated that designations would be important in making a decision to work with a new advisor.

- Most felt that multiple designations would reflect the ability of an advisor to deliver a broader range of services or deeper technical expertise.

Clients also feel that advisors who hold multiple designations can delve into a broader range of services (64%), and have deeper technical expertise (55%). Many clients (43%) feel it important that their advisor have more than one designation.

The change agenda demands adaptation by all wealth providers, including frontline advisors. Advice is the new currency and becoming “trusted partner” will be critical to retain and build relationships with the next generation of clients. For those willing to lean into the demographic wind and leap into the future, the opportunities loom large.

Strategizing for the new normal

As advice-givers and dealers strategize how to deploy a winning offer for the 2020s, here are some key questions to answer and some strategies to consider:

- How can advisors deploy a resonant and a resilient value proposition to their clients?

- How can advisors ensure client delight by combining elements of digital and in-person interactions?

- How can advisors transition to a 360-degree view of their client’s financial wealth?

- How can advisors tailor/customize portfolios to solve client’s unique needs? What data will they need to gather and analyze to do so?

Client Acquisition

- Time spent on client engagement—“Walk the floor” approach

- How many in person / calls advisors had with clients? How many visits to the client office?

- Lead qualification

- Top advisors who qualify and target specific clientele yield better results on client acquisition leading to higher conversion rates and penetration of products

- Client stakeholder mapping

- Wealth management firms need to enable advisors with key stakeholders to Connect, Engage and Acquire. This will expedite business development efforts and advisors on their end can keep updating firms of leadership moves

Client Servicing

- Revamp your investment management processes

- Embed technology tools which could build customized portfolios or advisors can “plug in” model portfolios based on client’s needs and stage in lifecycle

Client Retention

- Mapping client’s family tree

- To build trust and service next generation of advisors’s clientele, top advisors need to map client’s family tree and start engaging with them.

- Move from “Sales mindset” to “Client first approach”

- Understand client’s financial goals and keep in touch with them regularly to solve their problems

Disclaimer

This publication is intended only to convey information. The publisher and its data providers have taken all usual and reasonable precautions to determine that the information contained in this publication has been obtained from sources believed to be reliable, and that the procedures used to summarize and analyze such information are based on approved practices and principles in the investment funds industry. However, the market forces applicable to the subject matter of this report are subject to sudden and dramatic changes and data availability and reliability varies from one moment to the next. Consequently, neither the publisher nor its data providers makes any warranty as to the accuracy, completeness or timeliness of information, analysis or views contained in this publication or their usefulness or suitability in any particular circumstance. The publisher and its data providers disclaim all liability of whatsoever kind for any damages or losses incurred as a result of reliance upon or use of this publication. Past performance is no guarantee of future results.

Copyright

©Institutional Shareholder Services Canada Inc. (Investor Economics is a division of ISS Market intelligence, 2023. All rights reserved. The publisher hereby asserts its moral rights to the integrity of the work and to be associated with the work as its author by name. ©Morningstar Research Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future result.

Licence

Subject to the licences granted hereby, the publisher shall retain all right, title and interest in and to the information contained in this publication. The publisher hereby grants to the subscriber a non-exclusive, perpetual, worldwide, non-transferable, fully paid-up, irrevocable licence to use, copy, install, perform, display, modify and create derivative works of the publication and its contents, in whole or in part, solely in connection with the subscriber’s own business enterprise. Subject to the rights herein, no part of the publication or its contents may be reproduced, stored in a retrieval system or transmitted in any material form whatever by whatever means, whether electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the publisher. Any attempt to deliver such information outside of the subscriber’s enterprise must have prior written consent of the publisher.

Data Sources

In compiling the data sets underpinning its analysis and research, Investor Economics leverages both proprietary and third-party data sources. Specifically, Investor Economics compiles the monthly mutual fund reporting in Investor Economics’ Insight Advisory Service using monthly fund-level data provided by The Investment Funds Institute of Canada (IFIC), Morningstar Canada data, public filings, data submitted by mutual fund companies and gathered from a variety of public sources, including company websites. Individual segregated fund data is compiled by Investor Economics from data submitted by Canadian life insurance companies. Exchange-traded fund (ETF) data is compiled by Investor Economics from data submitted by ETF sponsors, sourced from Morningstar Canada data and other publicly available sources. Other data, including, but not limited to, fees, sales and asset distribution by province, load option and share classes, is compiled by Investor Economics from public filings, Morningstar Canada data or data and information submitted by fund companies. The raw data inputs are vetted, transformed, where necessary, and aggregated into data sets by Investor Economics and are protected by intellectual property rights including copyright. The title, ownership rights, and other intellectual property and proprietary rights in the data sets are held by Investor Economics and/or its licensors and suppliers. All unauthorized use is prohibited. The data and data sets are provided to end users of the Investor Economics services on an “as is” basis. Investor Economics makes no representations or warranties of any kind, either express or implied, with respect to the accuracy, timeliness, completeness, merchantability and fitness for any particular purpose of the data and data sets.

Published by Investor Economics

400 University Avenue, Suite 2000

Toronto, Canada M5G 1S5

P. 416.341.0114

F. 416.341.0115

Queries concerning subscriptions to this publication should be directed to CAClientSuccess@issmarketintelligence.com

To request a password for the Client Extranet section of the Investor Economics website, please contact: CAClientSuccess@issmarketintelligence.com

Key Contacts

Goshka Folda, Shankar Lakshman and Mary Taylor

Design and Production

Pam Byroe, Carol DeWolf and Shweta Pednekar

Succeed with ISS Market Intelligence

Founded in 1985, the Institutional Shareholder Services group of companies (“ISS”) empowers investors and companies to build for long-term and sustainable growth by providing high-quality data, analytics, and insight. Comprised of seven discrete business lines, ISS is today the world’s leading provider of corporate governance and responsible investment solutions, market intelligence and fund services, and events and editorial content for institutional investors and corporations, globally.

ISS Market Intelligence (MI) division provides critical data and insight to global asset managers, insurance companies and distributors to help them make informed, strategic decisions to manage and grow their business. Through its industry-leading combination of proprietary and integrated datasets, in-depth global research and reliable executive engagement, ISS MI delivers solutions for market sizing, competitor benchmarking, product strategy and opportunity identification across a wide range of financial products including funds, annuities, insurance, mortgages, and other instruments. The ISS MI group includes the industry-leading data platforms BrightScope, Financial Clarity, Flowspring, Local Market Share, Mortgage Clarity and Simfund, as well as a full collection of global research and analytic services including 529 & ABLE Solutions, Investor Economics, Market Metrics, and Plan For Life.